Most people know that the normal budgeting method is deeply flawed. In big organisations, a massive amount of time is spent setting the budget. The twelve-month period is fairly arbitrary and seldom fits with the underlying business rhythm. The process is highly political, with departments asking for more than they need (as they expect to be negotiated down) and spending money because it’s in the budget (especially at year end) rather than due to priorities.

Forty years without a budget – in a bank

Contrast this with Swedish bank Handelsbanken, who abolished budgeting more than forty years ago. At our 2015 conference, UK COO Andy Copsey explained how the 200 UK branches submit no advance finances. Instead, they are judged, in tables published quarterly, on just two key metrics: customer satisfaction and cost to income ratio.

The result of a model based on each branch being fully empowered is that Handelsbanken is arguably the most successful bank in Europe. It hardly suffered in the financial crash and has had, by some margin, the biggest increase in shareholder value since 2007 of any European bank.

An adaptive management model

What happens if there are sudden opportunities for growth? Or a need to respond to downturns? Do budgets provide the flexibility or actually get in the way of creating a flexible business that responds to change? Do they encourage people to use their own thinking?

At Happy our finances tend to be flexible. Our income varies month-by-month and our Operations Manager, who books trainers and allocates resources, works on the basis that the cost of courses should be under 50% of the income they bring in – to cover overheads such as our central London training centre.

Marketing spend, a relatively new concept at Happy, is also based on ratios. There is no annual marketing budget. Instead, our Marketing Manager works around a 5:1 ratio. It’s a tough ask, but the idea is that every pound spent generates five pounds of income. She is expected to try lots of things, on her own initiative, and can expand spending wherever she hits the ratio.

Trust and Accountability

The idea is to build both trust and accountability. Do you want your people spending because it’s in the budget, or fits the rules, or because they have used their best judgement and think it’s the right thing to do?

London Business School Professor Julian Birkinshaw (speaking here at BB2015) gives the example of Roche, who experimented with letting people self-approve their expenses (while making them visible on the intranet). 45% of staff said they felt more motivated, due to the extra trust and 3 in 4 said it took less time. What happened to the level of expenses claims? Spending fell as staff, feeling trusted, took more responsibility.

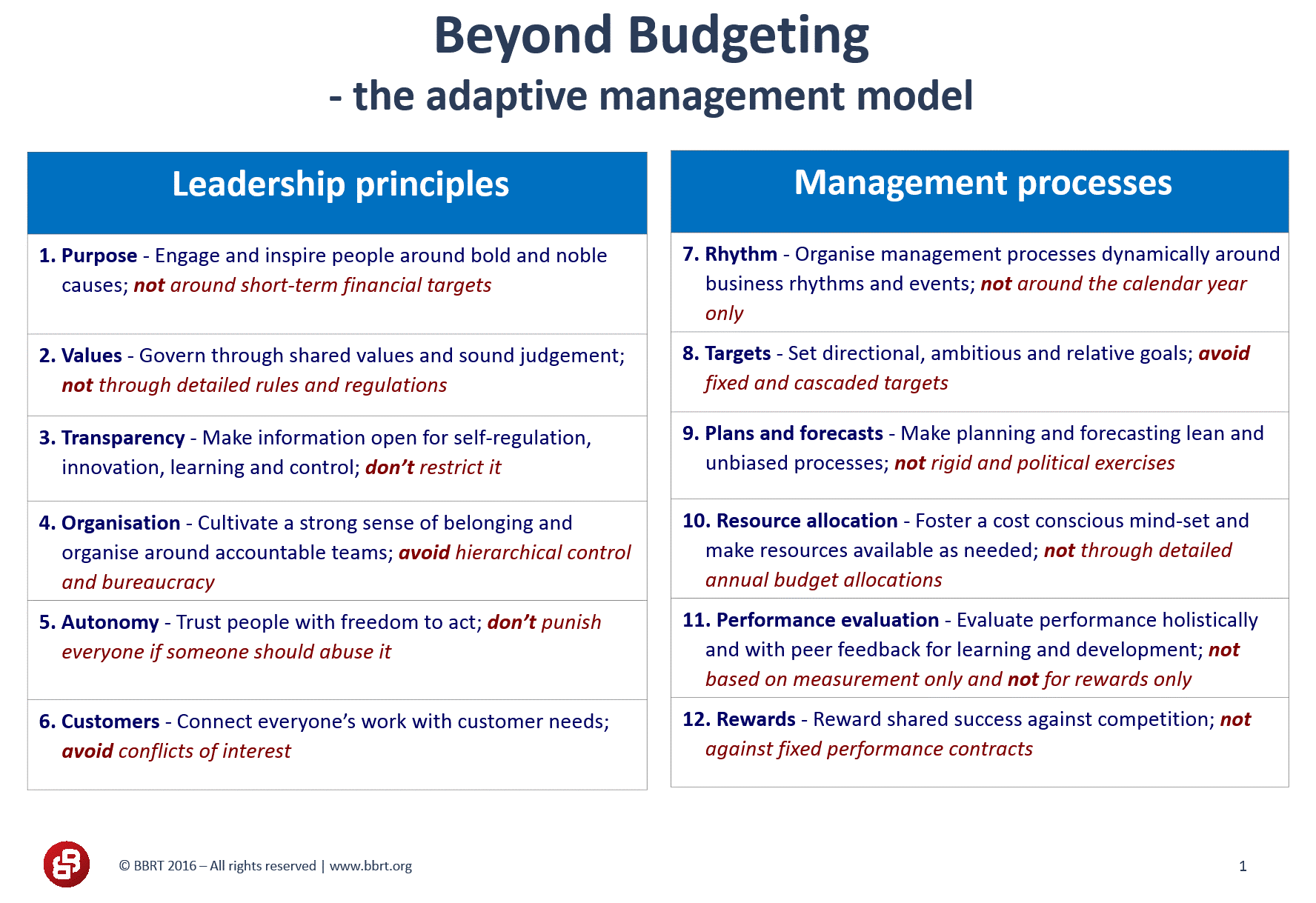

Twelve core principles have been developed to base post-budget companies on (see below). If your company is still based on command and control, it won’t make sense. But if you believe in trust and judgement based on values and a common cause, then moving beyond budgeting could be your next step.